san francisco sales tax rate history

Rate changed to 14 effective August 1996. The County sales tax rate is.

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue

1527500 Last Sold Price.

. SOLD JUN 3 2022. The California sales tax rate is currently. This is the total of state county and city sales tax rates.

OPEN SAT 12PM TO 2PM. This is the total of state county and city sales tax rates. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. 4 rows The current total local sales tax rate in San Francisco CA is 8625. The San Francisco sales tax rate is.

Puerto Rico state sales tax. Rates are for total sales tax levied in the City County of San Francisco. For tax rates in other cities see.

Proposition N passed in November 2010 created a new tax rate of 25 for transactions greater than or equal to 10 million and increased the tax rate on transactions of 5 million to 10 million from 15 to 20. The California sales tax rate is currently 6. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page.

Historical Tax Rates in California Cities Counties. The December 2020 total local sales tax rate was 8500. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

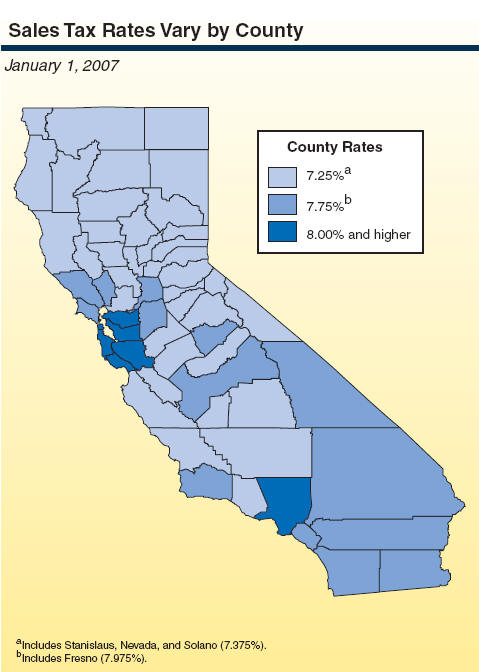

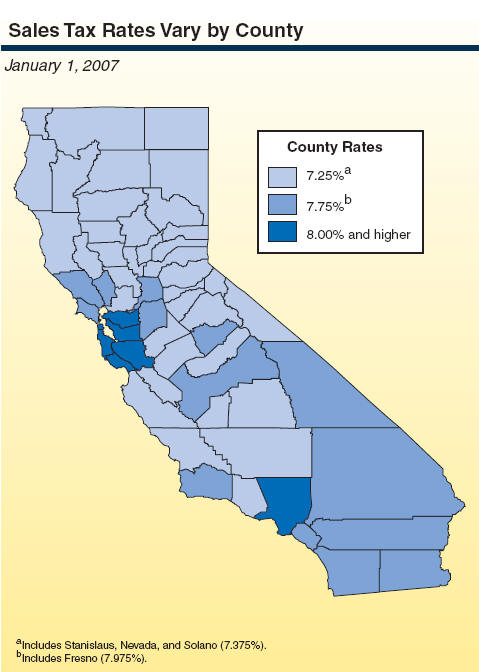

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. What is San Francisco sales tax rate 2020. The Sales and Use tax is rising across California including in San Francisco County.

Nearby homes similar to 640 Shotwell St have recently sold between 354K to 2625K at an average of 890 per square foot. Presidio of Monterey Monterey 9250. San Francisco County CA Sales Tax Rate.

In San Francisco the tax rate will rise. The California sales tax rate is currently 6. The California sales tax rate is currently 6.

Did South Dakota v. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. The current total local sales tax rate in San Francisco CA is 8625.

The minimum combined 2022 sales tax rate for San Francisco California is 863. The minimum combined sales tax rate for San Francisco California is 85. The County sales tax rate is 025.

The transfer tax rate had been previously unchanged since 1967. Presidio San Francisco 8625. At 725 California has the highest minimum statewide sales tax rate in the United States which can total up to 1075 with local sales taxes included.

Download all California sales tax rates by zip code. The County sales tax rate is 025. Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625.

This is the total of state county and city sales tax rates. The current total local sales tax rate in San Francisco CA is 8625. The current total local.

1501000 Last Sold Price. San Mateo County sales tax. The current total local sales tax rate in San Francisco County CA is 8625.

The December 2020 total local sales tax rate was 8500. What is the sales tax rate in San Francisco California. The California sales tax rate is currently 6.

The San Francisco Tourism Improvement District sales tax has been. How much is San Francisco tax. South San Francisco tax.

Rates have not changed since 1939 gas electricity 1975 steam and 1969 cable. The Sales and Use tax is rising across California including in San Francisco County. Ad Find Out Sales Tax Rates For Free.

What is San Francisco sales tax rate 2020. The minimum combined 2022 sales tax rate for San Francisco California is. The California sales tax rate is currently 6.

OPEN TODAY 12PM TO 4PM. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. This is the total of state county and city sales tax rates.

Sales and use taxes in California state and local are collected by the California Department of Tax and Fee Administration whereas income and franchise taxes are collected by the Franchise Tax Board. This scorecard presents timely information on economy-wide employment indicators real estate and tourism. The County sales tax rate is 025.

What is Bay Area sales tax. You can print a 9875 sales tax table here. The minimum combined sales tax rate for San Francisco California is 85.

SOLD MAY 20 2022. Homes similar to 1160 Mission St 709 are listed between 343K to 1288K at an average of 910 per square foot. The December 2020 total local sales tax rate was 8500.

The San Francisco sales tax rate is 0. Rate Tax History Rate Tax History 100 Living and Sleeping Accommodations120 70 All Other Taxable Transactions 70 All Other Taxable Transactions 2 January 1 2011 September 30 2017 2 December 1 1986 February 29 2004 3 October 1 2017 3 March 1 2004 November 30 2010 4 December 1 2010 May 31 2017. Notes to Rate History Table.

The San Francisco County Sales Tax is 025. Water Partial Year Rate Telephone Business Taxes Payroll Tax Exemption. The December 2020.

Fast Easy Tax Solutions. 832 Sutter St 503 San Francisco CA 94109. In San Francisco the tax rate will rise from 85 to 8625.

665 Guerrero St San Francisco CA 94110. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in. These transactions had previously been taxed at the 075 rate.

This is the total of state county and city sales tax rates.

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Property Taxes

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Frequently Asked Questions City Of Redwood City

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

California Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

California S Tax System A Primer

Hotel Prices Why Urban Hotels Cost So Much More Than Houses Or Apartments In The Same City

Sales Tax Collections City Performance Scorecards

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California City County Sales Use Tax Rates

Pin By Pejman Shirzadi On Latest Housing Market Trends Marketing Trends National Association Marketing

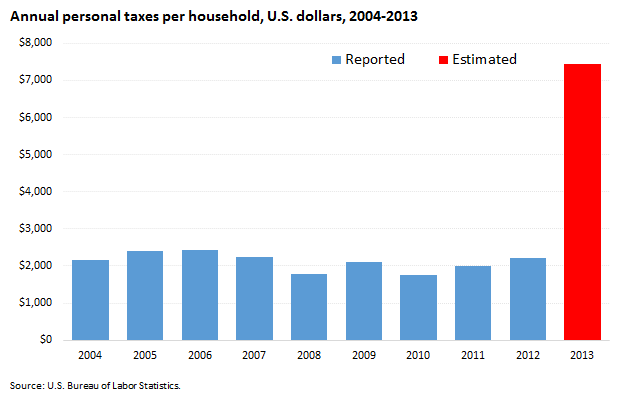

New Estimates Of Personal Taxes In Consumer Expenditure Survey Spotlight On Statistics U S Bureau Of Labor Statistics

Understanding California S Property Taxes

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Understanding California S Property Taxes

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep